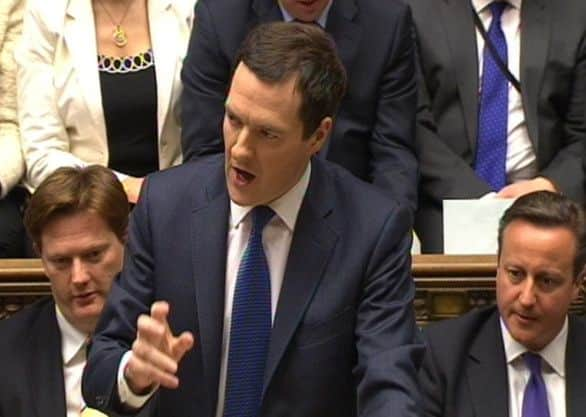

Budget podcast: Osborne’s great granny giveaway

• Podcast: Informed debate with Terry Jones, managing partner and head of tax at the Yorkshire office of accountants BDO.

SIMPLY CLICK HERE TO PLAY NOW or, if you prefer, DOWNLOAD FOR LATER (Right-click and choose Save Target As...)

• Real-time coverage at yorkshirepost.co.uk/budget.

Advertisement

Hide AdAdvertisement

Hide AdThe Chancellor unveiled radical reforms to tax rules on retirement pots and new-style flexible Isas where people can save up to £15,000 without the Treasury taking a cut.

As expected, he pushed the personal income tax allowance up to £10,500 next year. But he resisted pressure from Conservative backbenchers - and two Tory ex-chancellors - for a significant increase in the 40p income tax threshold, which rises more slowly than inflation to £41,865 next month and £42,285 in 2015/16.

With “grey voters” more likely than other age groups to go to the ballot box, critics accused the Chancellor of a politically-motivated statement designed to appeal to “blue rinses not blue collars”. But aides insisted that the measures are of more benefit to people in their 40s and 50s preparing for retirement than those already of pension age.

Mr Osborne set up a political battleground for the May 2015 election by announcing a £119.5 billion cap on overall welfare spending, excluding the state pension and jobseeker’s allowance.

Advertisement

Hide AdAdvertisement

Hide AdLabour announced it will back the policy in a Commons vote next week, but with the Chancellor already seeking £12 billion further welfare cuts after the election, it seems all but certain that the Tory manifesto will promise to reduce the cap, forcing Labour and Liberal Democrats to say whether they will do the same.

Hailing the success of the coalition’s austerity programme, Mr Osborne said UK plc will grow by a better-than-forecast 2.7% in 2014 and the Government will be back in surplus by 2018/19.

He highlighted predictions from the independent Office for Budget Responsibility (OBR) that employment will rise by 1.5 million over the next five years, with earnings growing faster than inflation in every year over the period.

“The message from this Budget is: you have earned it; you have saved it; and this Government is on your side, whether you’re on a low or middle income, whether you’re saving for your home, for your family or for your retirement,” Mr Osborne told MPs.

Advertisement

Hide AdAdvertisement

Hide Ad“The forecasts I’ve presented show: growth up, jobs up, and the deficit down.

“With the help of the British people, we’re turning our country around. We’re building a resilient economy.

“This is a Budget for the makers, the doers, and the savers.”

But Labour leader Ed Miliband responded: “The Chancellor spoke for nearly an hour but he did not mention one central fact: the working people of Britain are worse off under the Tories.”

Advertisement

Hide AdAdvertisement

Hide AdShadow chancellor Ed Balls said today’s figures showed Mr Osborne would have to borrow £190 million more than he planned over the course of this Parliament, while social security spending had been revised up by £13 billion over the same period.

Mr Balls said the Chancellor failed to deliver the spectacular “rabbit out of the hat” which many observers had expected - forcing Mr Miliband to rip up pages of his speech containing responses to measures which were never announced.

“We were waiting for him to say the interesting thing and it never quite came out,” said Mr Balls. “I think, as John Cleese may have said, that rabbit is deceased, it is no more.”

The Budget contained some eye-catching crowd-pleasers, including scrapping the duty escalator on wine and spirits, a penny off a pint of beer and £200 million to repair pot-holes, though tobacco taxes will go up by 2% above inflation.

Advertisement

Hide AdAdvertisement

Hide AdDuty on bingo halls will be cut by more than anticipated - from 20% to 10%. But fixed-odds betting terminals will be hit with 25% rates in recognition of their addictiveness to gamblers.

Inheritance tax will be waived when members of the emergency services die in the line of duty, and cash from Libor fines on bankers will go not only to military and emergency service charities, but also to search and rescue and lifeboat services, the Scouting movement and St John Ambulance.

Investment allowances for small and medium-sized businesses are being doubled to £500,000, one of a host of breaks for exporters and manufacturers.

In a signal that he believes “green levies” have gone too far, Mr Osborne unveiled a £7 billion package to cut annual energy bills for typical manufacturing companies by £50,000, while saving families £15 a year too.

Advertisement

Hide AdAdvertisement

Hide AdCompensation to protect energy-intensive industries from the rising cost of green levies was extended, prompting Friends of the Earth to complain that the Chancellor was “caving in to big business lobbying on pollution tax”.

But the Chancellor targeted most of his big measures at savers and pensioners, with what he described as “the most far-reaching reform to the taxation of pensions since the regime was introduced in 1921”.

Mr Osborne said people would be “trusted” with more control over their pension pots, and no longer obliged to buy an annuity at low rates.

Those approaching retirement will get free financial advice, and they will be able to draw down as much of their defined contribution fund as they want, even if they are in line for relatively small incomes.

Advertisement

Hide AdAdvertisement

Hide AdInstead of being hit with punitive 55% tax on sums they extract from funds, they will instead pay normal tax rates. Chris Sanger, head of tax policy for Ernst & Young, said Mr Osborne’s “great granny giveaway” would “make saving for a pension much more attractive”.

A new state-backed Pensioner Bond will help people who have suffered low returns since interest rates were slashed to keep the wider economy afloat in the wake of the crash.

Up to £10 billion of the bonds will be issued to as many as one million pensioners, who will be able to save up to £10,000 at interest rates likely to be 2.8% on the one-year version and 4% if they lock in for three years.

The cash and stocks elements of Isas will be merged into a larger tax-free vehicle, with savers now allowed to stash up to £15,000 a year in whatever form they want.

Advertisement

Hide AdAdvertisement

Hide AdThe cap on Premium Bonds will also be lifted from £30,000 to £40,000 in June, and to £50,000 next year. And the 10p starting rate for income from savings would be abolished, benefiting 1.5 million low-income savers.

Business welcomed the Budget, hailed by British Chambers of Commerce director general John Longworth as “disciplined, focused, and geared toward the creation of wealth and jobs”.

CBI director general John Cridland said: “The Budget will put wind in the sails of business investment, especially for manufacturers.

“This was a make-or-break Budget coming at a critical time in the recovery and the Chancellor has focused his firepower on areas that have the potential to lock in growth.”

Advertisement

Hide AdAdvertisement

Hide AdBut TUC general secretary Frances O’Grady said: “This was a pre-election Budget, with its giveaways aimed at the better-off rather than lifting the living standards of the many.”

And Unite general secretary Len McCluskey said: “Ordinary people will be asking themselves are they better off? The simple answer is no. This was a blue-rinse budget for the stockbroker belt, who will celebrate their tax reductions and help with their savings.

“But for real Britain, this is devoid of hope and genuine effort to tackle the crisis in living standards facing ordinary people.”

• Podcast: Informed debate with Terry Jones, managing partner and head of tax at the Yorkshire office of accountants BDO.

Advertisement

Hide AdAdvertisement

Hide AdSIMPLY CLICK HERE TO PLAY NOW or, if you prefer, DOWNLOAD FOR LATER (Right-click and choose Save Target As...)

BUDGET AT A GLANCE: ECONOMY

• Economy grew by ‘three times as much’ as forecast 0.6 per cent in 2013.

• Borrowing expected to be £108billion this year - £12billion less than forecast a year ago.

WELFARE & TAX AVOIDANCE

• People signed-up to disclosed tax avoidance schemes to be required to pay their taxes up front.

Advertisement

Hide AdAdvertisement

Hide Ad• Tax on homes owned through a company to be extended from residential properties worth more than £2million to those worth more than £500,000. Residential property worth more than £500,000 bought through corporate envelope to be liable to 15 per cent stamp duty.

• Compliance checks on migrants claiming benefits they are not entitled to to save almost £100million.

• Inheritance tax waived for emergency services personnel who ‘give their lives protecting us’. VAT waived on fuel for air ambulances and inshore rescue boats.

BUSINESS

• Lending for exporters doubled to £3billion and interest rates on that lending cut by one third.

Advertisement

Hide AdAdvertisement

Hide Ad• Reform of air passenger duty so all long haul flights carry the same tax rate as currently charged for flights to USA.

• Housing policies to support more than 200,000 new homes.

• Additional £140million made available for repairs and maintenance to flood defences. Additional £200million for potholes.

• Mr Osborne said he was ‘determined’ that the HS2 rail link should go ‘further north faster’.

• Business rate discounts and enhanced capital allowances in enterprise zones extended for further three years

Advertisement

Hide AdAdvertisement

Hide Ad• The 2 per cent increase in company car tax to be extended to 2017 and 2018.

DUTIES

• Fuel duty rise planned for September ‘will not take place’.

• Duty on fixed odds betting terminals increased to 25 per cent, horse racing betting levy extended to offshore bookmakers

• Tobacco duty to rise by 2 per cent above inflation, and the escalator extended for the rest of the next Parliament.

Advertisement

Hide AdAdvertisement

Hide Ad• Alcohol duty escalator scrapped, so taxes will rise in line with inflation except for on whisky and other spirits

• Duty on ordinary cider frozen. Beer duty cut by 1p a pint.

PERSONAL TAXATION & SAVINGS

• Personal tax allowance to be raised to £10,500 next year, resulting in £800 income tax reduction for typical taxpayer.

• Transferable tax allowance for married couples to rise to £1,050.

Advertisement

Hide AdAdvertisement

Hide Ad• Cash and stocks ISAs to be merged into single New ISA with annual tax-free savings limit of £15,000 from July 1.

• Cap on Premium Bonds to be lifted from £30,000 to £40,000 in June and £50,000 in 2015

PENSIONS

• Reform of taxation of defined contribution pensions to help 13million people from March 27.

• Tax on cash taken out of pension pot on retirement to be reduced from 55 per cent to 20 per cent.

Advertisement

Hide AdAdvertisement

Hide Ad• All tax restrictions on pensioners’ access to their pension pots to be removed, ending the requirement to buy an annuity.

• Abolition of 10p starting rate of tax on income from savings.

• Real-time coverage at yorkshirepost.co.uk/budget.