Budget gap widens despite pause in living costs

Research by Loughborough University for the York-based Joseph Rowntree Foundation (JRF) revealed the cost of a decent standard of living, as defined by the public, has stopped rising for the first time since the recession began in 2008. However, the gap between people’s incomes and the amount they need to cover their essential costs has widened dramatically.

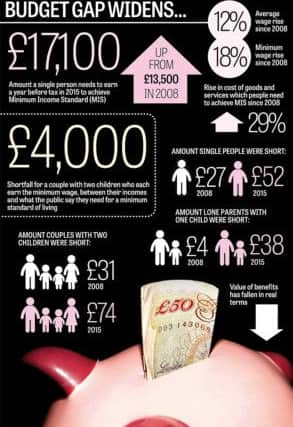

It found that a single person needs to earn £17,100 a year to achieve a Minimum Income Standard (MIS) - the figure based on goods and services required to maintain a socially acceptable standard of living. This is up from £13,500 in 2008. Across differing groups, all sectors are have seen a rise in the amount they fall short by each week compared to in 2008.

Advertisement

Hide AdAdvertisement

Hide AdWorking single people were £52 short a week in 2015, compared to £27 short in 2008; couples with two children were £74 short this year compared to £31 in 2008; while lone parents with one child were £38 shorts in 2015 compared to £4 short in 2008.

Shortfalls were increased when it came to those reliant on benefits, with couples with two children experiencing the biggest shortfall, of £196 a week this year compared top £148 in 2008.

Since 2008, average wages have risen by 12 per cent and the minimum wage has risen by 18 per cent. But over the same period, the cost of the goods and services which people need to achieve MIS has risen by 29 per cent, the report said. The value of benefits has also fallen in real terms.

JRF chief executive Julia Unwin said: “After seven years of declining living standards, the pause in rising costs is a very welcome respite. But many low income households are still much worse off than in 2008, leaving them struggling to make ends meet and reliant on benefits to top up their incomes.

Advertisement

Hide AdAdvertisement

Hide Ad“A couple with two children who each earn the minimum wage faces a shortfall of almost £4,000 a year between their incomes and what the public say they need for a minimum standard of living. We need to see action to raise wages, build more genuinely affordable homes and tackle the UK’s low productivity to help people get on at work.”

The report’s author Donald Hirsch, of Loughborough University, said: “Near-zero inflation is a particularly welcome relief for families whose income relies partly on benefits, which are no longer increased automatically in line with prices. But modest inflation is expected to return.

“Even though earnings are forecast to grow healthily in the next few years, rising prices will prevent low earners from becoming better off if their tax credits are frozen - and more so if threats to cut them are implemented in the forthcoming Budget.”

To help narrow the gap between wages and basic living costs, the Foundation is calling for action to boost productivity to create better paid jobs for people on low incomes, for employers to pay the Living Wage where affordable and a greater supply of affordable homes.

Advertisement

Hide AdAdvertisement

Hide AdAddressing these issues will help reduce the need for people on low incomes to rely so heavily on tax credits and housing benefit to maintain a decent living standard, JRF said.

The report comes as the four UK children’s commissioners joined forces to urge the Government to halt its programme of benefit cuts to prevent more young people being pushed into poverty. The commissioners for England, Scotland, Wales and Northern Ireland said child poverty rates across the UK were “unacceptably high” and that there had been a failure to protect those from the most disadvantaged backgrounds.

A Department for Work and Pensions spokesman said welfare reforms were focused on making work pay.

Benefits report ‘misleading’

THE Government has been urged to press ahead with deeper welfare reforms by the author of a controversial report which showed more than half of households in the UK receive more from the state in welfare payments and pensions than they pay in tax.

Advertisement

Hide AdAdvertisement

Hide AdThe report’s co-author, Adam Memon, from the Centre for Policy Studies think tank, said the figures displayed levels of “welfare dependency” which were too high.

However, TUC general secretary Frances O’Grady described the report as “a blatant attempt to give the Government political cover to slash public services and in-work benefits” and dismissed it as “extremely misleading”.