Yorkshire Water attempts to reassure customers amid questions about mounting debts

It comes as there are fears Thames Water, which serves a quarter of the UK population, is on the brink of collapse and may need to be nationalised, as it is struggling to service its £14bn debt pile following interest rate rises. However, customers have been reassured supplies will not be disrupted.

Regulator Ofwat said it is closely monitoring suppliers to ensure “they have the financial backing to deliver for customers”.

Advertisement

Hide AdAdvertisement

Hide AdBut it has previously raised concerns about the financial resilience of Yorkshire Water, which reported net debt of £5.6bn in 2021/22, up from £4.3bn the previous year.

The company, led by Chief Executive Nicola Shaw, also announced a statutory loss of £368.6m, after recording an £11.1m profit the previous year.

A company spokeswoman said: “We’ve been significantly improving our financial position over the last six months with a stronger and more resilient balance sheet.

“This has been supported by an equity injection from shareholders of some £500m and additional funds raised from the capital markets including £200m in the last week and £500m in February.”

Advertisement

Hide AdAdvertisement

Hide AdYorkshire Water said shareholders agreed to provide the money before the issues with Thames Water came to light.

Total debt in the water sector hit £60.6bn last year and suppliers say they borrow to invest in infrastructure and tackle issues with leaks and pollution, but there are concerns that some are not generating enough profit to pay off their loans and the interest.

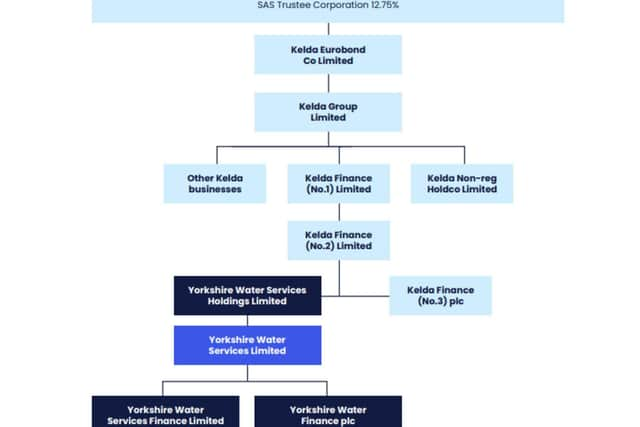

Yorkshire Water spent £282m on covering interest payments in 2021/22. Most of that money (£264m) was used to pay interest on loans provided by a group of companies – run by an investment consortium called Kelda Holdings.

Yorkshire Water is part of that complex group, known as Kelda Group, and it paid dividends of £52.6m to the Jersey-based Kelda Holdings in 2021/22. But it also earned £42m through interest charged on loans it made.

Advertisement

Hide AdAdvertisement

Hide AdLast year, Ofwat launched an investigation after it found Yorkshire Water was owed more than £940m by another company in the group – Bradford-based Kelda Eurobond Co Limited.

The probe ended after it set out a plan to recover the money by March 2027 and secure £100m of shareholder investment to reduce storm overflow spills.

It came after Kelda Eurobond Co Limited reported a loss of £563.5m in 2021/22 and net debt of £7.5bn.

In December, Ofwat said Yorkshire Water had taken “substantial steps” to strengthen its financial resilience, but it would continue to closely monitor the company.

Advertisement

Hide AdAdvertisement

Hide AdIts gearing level, which is a measure of a company’s financial risk, stood at 72 per cent – higher than the average of 68.5 per cent. A higher level indicates a higher proportion of debt compared with its equity.

Earlier this week, Ofwat said it will keep water companies “under close scrutiny” and work to ensure “they have the financial backing to deliver for customers and the environment.”

A spokesman added: “We have been clear that Thames Water has significant issues to address – their environmental record and leakage performance, for example, are poor.

“Alongside the turnaround of their operational performance, they need to improve their financial resilience too.

Advertisement

Hide AdAdvertisement

Hide Ad“But that is all in the context of a company that has strong liquidity – it recently received an additional £500m from shareholders and has £4.4bn of cash and committed funding.

“Overall, the sector is continuing to attract international capital and is especially attractive to long term investors such as pension funds.”

Ofwat has previously stated that investment in the industry has roughly doubled since privatisation in 1989, and companies spent around £6bn a year on upgrading their infrastructure between 2015 and 2020.

But they also paid out £57bn in dividends to shareholders of parent companies between 1991 and 2019.