Morrisons sees shares rally as new initiatives start to pay off

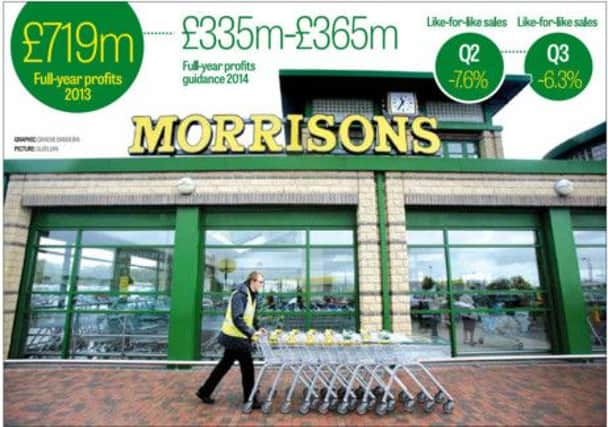

The Bradford-based grocer reported a 6.3 per cent drop in like-for-like sales in the 13 weeks to November 2.

The figure was better than the 7.6 per cent fall in the previous quarter and chief executive Dalton Philips said he was encouraged by initiatives to recapture market share.

Advertisement

Hide AdAdvertisement

Hide AdAs part of a wider plan to invest £1bn in price cuts over three years, the company recently launched a new loyalty card called ‘Match & More’, which promises to match prices at Aldi and Lidl.

Mr Philips declined to say that the worst was over, but said: “We’re firmly on track. It will take time for sales to improve.”

The new ‘Match & More’ card price matches brands and own label products against Tesco, Asda, and Sainsbury’s and is the first to price match Aldi and Lidl. Customers get points at the till if products are cheaper elsewhere and once these have mounted up they are given a £5 voucher off their next shop.

“The highlight of the quarter was ‘Match & More’. We’re very happy with the launch programme and the customer response,” said Mr Philips.

Advertisement

Hide AdAdvertisement

Hide AdHe declined to comment on reports the group has signed up over a million customers.

“We’ve got 12 million transactions a week coming through. It’s going extremely well and we’re very encouraged. Customers are getting their £5 vouchers back.”

The group has decided to delay its Christmas campaign until November, reversing last year’s decision to start it in October.

“I thought last year we were too early. We wanted to have a Christmas bonus that’s very simple. I’m feeling pretty bullish about this Christmas. We want to neutralise on price against the discounters and anyone else out there,” said Mr Philips.

Advertisement

Hide AdAdvertisement

Hide Ad“This year we’ll have the very best price. We’ve strategically positioned ourselves to be in the place to win.”

The shares rose xp to xp on the confident outlook.

Analysts noted the improving trends in basket size. Last Christmas items per basket fell 6.9 per cent, but the fall had reduced to 2.4 per cent in the 13 weeks to November 2.

In addition, the group gave further clarity on profit guidance, saying that full year pre-tax profits will be between £335m and £365m, having previously said they would be between £325m and £375m.

Last year the group made a pre-tax profit of £719m.

Asked about the opening of Netto’s first new store in Leeds yesterday, Mr Philips said: “It’s one store today. We’ll obviously be looking at it and see where it fits in.”

Advertisement

Hide AdAdvertisement

Hide AdFollowing the launch of the online business in January, the group said internet sales added 0.7 per cent to like-for-like sales during the quarter.

Finance director Trevor Strain said: “We’re very pleased with how online has gone over the 10 months. In terms of customer reaction, we’re incredibly pleased.”

Mr Philips is under pressure to lead a turnaround ahead of the arrival of the group’s new chairman next year. Andy Higginson, a former Tesco finance director, will succeed Ian Gibson.

Analyst David Gray, at Planet Retail, said: “If the price-matching loyalty scheme doesn’t deliver the necessary result, Philips’ days may yet be numbered.”

Mr Philips said he did not consider the outcome of the Christmas trading period as “make or break” for his own future at the firm.