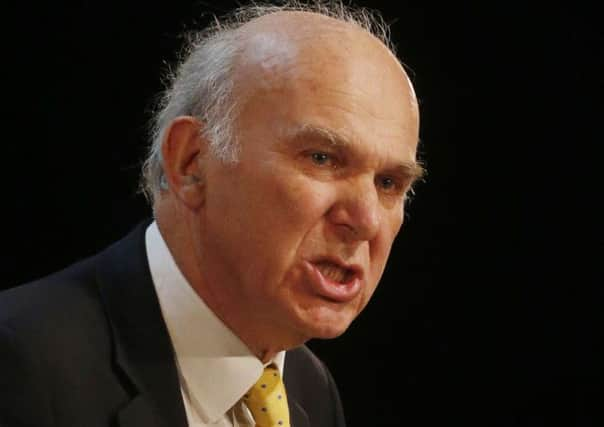

Google tax ‘more effective’ with global input, Cable says

However, he said the policy is “the right thing to do” because of scale of corporate tax avoidance.

Chancellor George Osborne announced the so-called ‘Google tax’ at the Autumn Statement, having previously warned he would get tough with companies using complex tactics to reduce bills.

Advertisement

Hide AdAdvertisement

Hide AdThe Diverted Profits Tax was included as part of this week’s Draft Finance Bill. Based on two rules, it will address misuse of permanent establishment rules and intra-group deals and divisions that “lack economic substance”.

Mr Osborne has been criticised for moving ahead with plans after the Organisation for Economic Cooperation and Development (OECD) has recommended its own measures.

Speaking to The Yorkshire Post, Dr Cable said the policy would have greater impact if it had been a collaboration between international authorities.

He said: “People feel very strongly about it and rightly so - these companies should be paying their share of tax.

Advertisement

Hide AdAdvertisement

Hide Ad“The issue is a practical one about how you frame law in such a way you compel them to do so and you make it stick.

“In a way, these things are more effective if they’re through agreement by governments, rather than individual governments going off on their own, but the problem is trying to get agreement.”

Negotiations with foreign authorities were “proving quite slow”, which prompted the UK government to move ahead alone.

“I think was the right thing to do,” he said.

Earlier this week, PwC head of tax Kevin Nicholson had a heated exchange with MPs on the Public Accounts Committee over tax planning via Luxembourg structures.

Advertisement

Hide AdAdvertisement

Hide AdMr Nicholson fiercely denied misleading the committee in a previous hearing, where he said PwC did not “mass market” tax avoidance schemes.

If tax rates vary “a great deal” internationally, companies will “take advantage” of the disparity, Dr Cable said.

“We’re going to have to co-operate much more with other European countries and others,” he added.

Dr Cable was in the region yesterday as he launched four employer-led National Colleges, two of which will be based in Yorkshire and the Humber.

Advertisement

Hide AdAdvertisement

Hide AdAn £80m capital investment from the Government will be matched by employers, with up to £160m expected to go to the project by 2017. The four institutions will cater for 10,000 students by 2020.

Sheffield’s Advanced Manufacturing Research Centre (AMRC) will be home to the National College for Advanced Manufacturing, working in conjunction with Coventry’s Manufacturing Technology Centre and developing a network of national hubs.

A National College for Wind Energy will be located on the Humber, building on the £160m investment announced by Siemens earlier this year.

Colleges for digital coding and creative and cultural industries will be based in London and Essex respectively.

Advertisement

Hide AdAdvertisement

Hide AdSeven National Colleges are now planned, with Doncaster due to be co-hosts to a High Speed Rail centre.

Dr Cable said: “The distribution of these centres does reflect the strength of the North of England and South Yorkshire in advanced manufacturing.”

The Liberal Democrat MP for Twickenham said the colleges will present a “fantastic” career for young people, who will study to degree level.

It will also meet the “chronic need for advanced skills” as the economy grows. However, he said a lot more needs to be done to address the skills shortage in the industries, as they are “crucial to growth”.

--

Advertisement

Hide AdAdvertisement

Hide AdParents in Yorkshire and the Humber are more likely to discuss alterative routes to careers with their children than elsewhere in the country, according to research.

Despite this, the survey from EY, GTI Media and the Association of Graduate Careers Services found almost seven out of ten still actively encouraged teens to enter higher education.

Alistair Denton, partner at EY in Yorkshire and Humberside, said many parents still see university as “the safest route” to a career.

He said: “There is an important place for university.

“However, in reality, entering the workplace straight after A-Levels can play to the strengths of some highly-focused students and provide them with a real head-start in their careers.”