Fed starts tapering process

The central bank modestly trimmed the pace of its monthly asset purchases, by $10bn (£6bn) to $75bn, and sought to temper the long-awaited move by suggesting its key interest rate would stay at rock bottom even longer than previously promised.

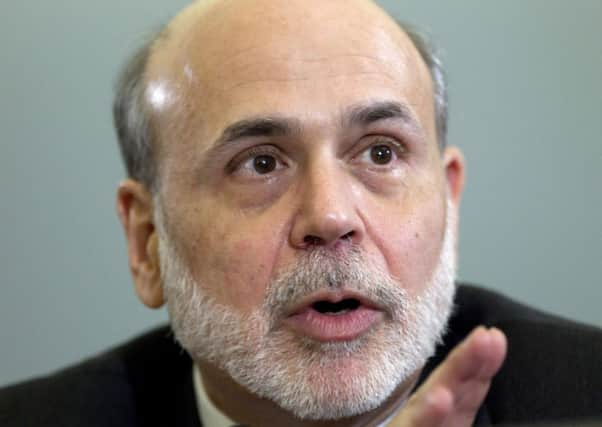

At his last scheduled news conference as Fed chairman, Ben Bernanke said the purchases would likely be cut at a “measured” pace through much of next year if job gains continued as expected, with the programme fully shuttered by late 2014.

Advertisement

Hide AdAdvertisement

Hide AdThe move, which surprised some investors but did not cause the market shock many had feared, was a nod to better prospects for the economy. It marked a historic turning point for the largest monetary policy experiment ever.

“The recovery clearly remains far from complete,” Bernanke said. But “we’re hopeful ... we’ll begin to see the whites of the eyes of the end of the recovery”.