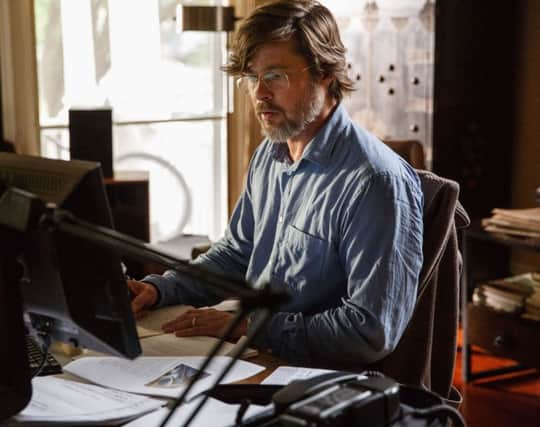

The Big Short: How Brad Pitt took on America's fat cats

Except, of course, that The Big Short – a chronicle of the American credit and housing bubble collapse of 2005 featuring a quartet of banking gurus that predicted it and made millions from it – is also very funny.

That’s partly down to director Adam McKay, former chief writer for Saturday Night Live now better known as the filmmaker behind Anchorman and Step Brothers.

Advertisement

Hide AdAdvertisement

Hide AdCertainly Pitt, whose production company Plan B bagged the rights to adapt the book behind the movie, sees the McKay effect as one of the primary reasons why The Big Short – powered by the combined star wattage of Christian Bale, Ryan Gosling, Steve Carell and Pitt himself – has been so successful.

Bale plays money manager Michael Burry. Gosling plays Wall Street banker Jared Vennett. Carell is hedge-fund manager Mark Baum. And Pitt pops up as banker turned environmental doomsayer Ben Rickert, who helps the trio make a bet against the traditions and practices of Wall Street.

“Adam cracked this film,” says Pitt.“CDOs, inflatable mortgages and all the other terms I can’t quite pronounce… it’s very dry material. And having known Adam for some time and known he was looking for something like this, it was just a perfect find. It’s putting the story through his filter that made it accessible and even entertaining.”

A decade ago thousands of Americans took out home loans based on delinquent financial products that eventually imploded. Watching closely were four men who saw what could – and would – happen.

Advertisement

Hide AdAdvertisement

Hide AdThey were not Ivy League number crunchers. Instead they were misfits who defied the prevailing wisdom of banks, government regulators and media pundits and bet everything they had on an unprecedented failure of the American housing market.

In the case of Pitt’s character, McKay reveals that prior to filming the actor immersed himself in what he calls Rickert’s anti-establishment belief system. “The real guy believes climate change and corrupted economies are destroying natural resources. He really does think the world’s going to end in the next 50 or 100 years. Brad ran with that.

“Ben’s not just some crazy doomsday prepper. He’s a brilliant guy and everything he does is backed up by data, even though the combination of it all seems pretty crazy. Brad wanted to dig into that mindset.”

By the time the market crashed in 2008 millions of Americans had lost everything. But the US taxpayer bailed out the financial institutions. And the investors… well, they walked away with billions. Says Steve Carell: “If I were at a cocktail party and someone asked me what this movie is about, I’d say, ‘Do you remember when subprime mortgages went bust and all these companies went out of business and not one person went to jail? ‘Do you remember that? Do you remember how everything just exploded? And then the government came in and bailed everybody out and everything seemed okay?’ That’s what this movie is about. It’s a horror movie and way scarier than the way I just described it.”

Advertisement

Hide AdAdvertisement

Hide AdThe Big Short marks Pitt’s latest collaboration with author Michael Lewis, who previously wrote Moneyball: The Art of Winning an Unfair Game, which was turned into a smash hit movie that presented Pitt with his second Oscar nomination as best actor.

The Big Short: Inside the Doomsday Machine is the follow-up. Adam McKay, king of absurdist comedies and arch political satirist, describes it as the book he couldn’t put down. “I started reading the book at around 10:30 at night and finished at six in the morning,” he recalls. “The next day I told my wife about the characters: how the book weaves together all these different storylines and how it’s like a ‘get rich’ story that’s ultimately about the fall of the banking system, corruption and complacency, and how it’s funny and it’s heartbreaking at the same time. And she’s like, ‘You should do it.’”

Pitt claims it was Lewis’s book that provided his epiphany. In interviews he has spoken of “getting to the bottom of the rabbit hole” to understand “the climate, the mistakes, the greed”.

In fact the 80s-style mantra of Gordon Gekko, that “Greed is Good”, permeates The Big Short. It wasn’t our non-heroes that caused the problem but they sure as hell profited from it. “This story was really important for me to tell,” says Pitt. “The idea of losing your home is very personal to me as a father and I cannot shake those images of the families that were put out and lost their homes, lost their savings, and lost their pensions. And the fact that no one – no senior bank official – was held accountable is crazy to me.

Advertisement

Hide AdAdvertisement

Hide Ad“Nothing has changed. It’s a little different shape but it’s the same ‘greed is good’ mentality, the same entitlement to make money off the backs of other people without responsibility, still exists right now. It’s something we’ve got to watch out for.”

Is there a sense that Pitt, at 52, may be looking to abdicate as one of Hollywood’s premier leading men? Recent outings have seen as many ensemble pieces and supporting gigs as starring roles. And he’s a prolific producer.

“I’m really proud of this one,” he says. “It was a really important story to me.”

On nationwide release. Tony Earnshaw